Updated on 27.11.2023

Interest Rates on deposits for various periods for all the banks in India are not the same. Here we have provided interest rates on deposits offered by all the public sector banks and large private sector banks in India. You may compare them at a quick glance.

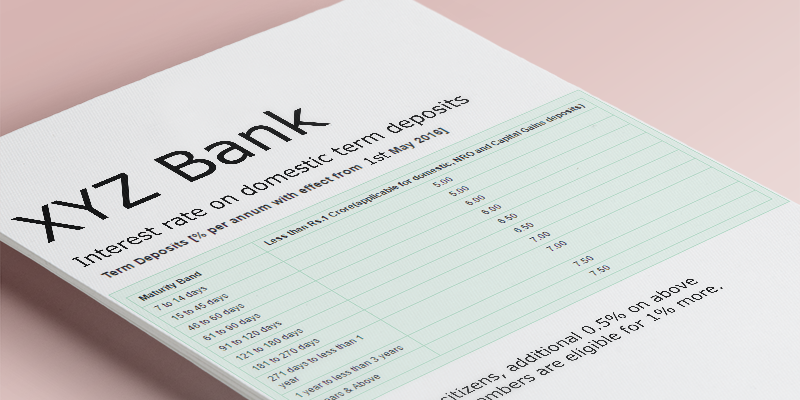

The names of public sector banks and private sector banks are separately listed below in alphabetic order. The table on the right side of the bank’s name shows the interest rate for domestic deposits of below two crores offered by the respective bank for the period of 1 year, 2 years, 3 years 5 years, and above 5 years which are updated at regular intervals.

CLICK the Bank’s name that navigates you to the concerned bank’s official website showing the present interest rate, offered by them on all types of deposits including Domestic Fixed deposits of above Rupees 2 crores, SB A/cs, NRE/NRO/FCNR deposits.

Almost all the banks offer additional interest for Senior citizens on domestic deposits. Please find out the interest rates for Senior citizens and Super Senior Citizens (80 years and above age)

CLICK THE BANK’S NAME FOR THE LATEST RATES (LAST UPDATED on 27.11.2023)

| Public sector Banks as of 27.11.2023 interest rate in percentage per annum |

| Bank’s Name | 1 Year | 2 Years | 3 Years | 5 Years | 5+ Years | Special rates |

| Bank of Baroda | 6.75 | 6.75 | 7.25 | 6.50 | 6.50 | |

| Bank of India | 6.50 | 7.25 | 6.50 | 6.00 | 6.00 | |

| Bank of Maharashtra | 6.50 | 6.25 | 6.25 | 6.00 | 6.00 | |

| Canara Bank | 6.85 | 6.85 | 6.80 | 6.70 | 6.70 | |

| Central Bank | 6.75 | 6.75 | 6.50 | 6.25 | 6.25 | |

| IDBI Bank (privatized) | 6.80 | 6.80 | 6.50 | 6.50 | 6.25 | |

| Indian Bank | 6.30 | 6.70 | 6.25 | 6.25 | 6.10 | |

| I.O.B | 6.80 | 6.80 | 6.50 | 6.50 | 6.50 | 444 days 7.10% |

| Punjab National Bank | 6. 75 | 6.80 | 7.00 | 6.50 | 6.50 | 444 days 7.25% |

| Punjab & Sind Bank | 6.20 | 6.20 | 6.00 | 6.00 | 6.25 | |

| UCO Bank | 6.50 | 6.50 | 6.30 | 6.20 | 6.10 | |

| Union Bank | 6.30 | 6.30 | 6.50 | 6.70 | 6.70 | |

| State Bank of India | 6.80 | 7.00 | 6.50 | 6.50 | 6.50 |

Rate of interest (percent per annum) on term deposits of major private sector banks -at a glance.

Last Updated on 27.11.2023

|

Bank’s Name |

1 Year |

2 Years |

3 Years |

5 Years |

5+ Years |

As appeared on the official websites of the concerned banks as of 24.05.2023 |

|

6.70 |

6.70 |

7.10 |

7.00 |

7.00 |

||

|

7.15 |

7.55 |

7.60 |

7.40 |

7.25 |

||

|

6.80 |

7.05 |

7.00 |

6.60 |

6.60 |

||

|

6.25 |

7.25 |

6.50 |

6.50 |

6.50 |

||

|

6.60 |

7.00 |

7.00 |

7.00 |

7.00 |

||

|

6.70 |

7.10 |

7.00 |

7.00 |

6.90 |

||

|

7.10 |

7.00 |

650 |

6.50 |

6.50 |

||

|

6.95 |

7.00 |

6.50 |

6.50 |

5.80 |

||

|

7.00 |

7.00 |

7.00 |

6.50 |

6.25 |

||

|

7.10 |

7.10 |

6.50 |

6.20 |

6.20 |

||

|

7.50 |

8.00 |

7.50 |

7.10 |

7.00 |

||

|

6.60 |

6.60 |

6.60 |

6.00 |

6.00 |

||

|

7.75 |

7.25 |

7.25 |

7.25 |

7.00 |

Disclaimer: Public Sector Banks are the banks where the Government of India has the majority capital stake and in Private Sector Banks, the private promoters and the general public are the shareholders. This website neither recommends the readers put their deposit in any specific bank nor take any responsibility, in the event of a bank failing or going into liquidation or reconstructed or amalgamated, or merging with another bank.

As interest rates are subject to change without prior notice, the depositor shall ascertain from the concerned bank, the rates on the value date of FD. Readers/bankers/financial institutions may inform us about updates, corrections or any inclusions to be made in this post. Banks at their discretion offer additional interest to the resident senior citizens (of age 60 years and above), over and above the rate of interest admissible to the general public. (Example: plus 0.25% p.a., 0.40% p.a., plus 0.50% p.a., maximum up to plus 1.00%). At present, most banks offer 0.50% additional interest to Senior citizens over and above the rate of interest admissible to the general public. Senior Citizens are therefore required to check the additional interest offered to them by the concerned bank before depositing their money.

- Foreign Trade Policy: FTP policy – 2015-2020

- Foreign Trade Policy: FTP-Structural Changes during 1990s

- These things Health Policyholders needs to know: Take a look at updated IRDA rules

- RBI redefines Payment aggregators scope and KYC compliance

- Economic transformation: Global Economy and Economic Reforms in India.

Please prefer Lakshmi Vilas Bank Interest rates in this site also. They are giving High Rate Of Interest on Savings and Term Deposits..

O.K. noted

I’m not able to track the official website of the LVB for deposit rate. If possible send me the link.

This bank has been merged with DBS bank

I am SEP 1998 VRS pensioner of Canara Bank with BP Rs.7069/. What will be my pension for Feb 2018.

(2) What is the position of Bank Pensioner after recent Supreme court’s judgement?

Thanks, Regards. SBM

Sir, RAte of interest of O.B.C. needs correction.

Thank you, sir. I have changed the rate, as well as revised URL of the new official website.Thanks once again and regard.

had given a personal guarantee of a corporate loan.Does the personal loan needs to be renewed after a year or after a certain period or it is limitless till the company or i am alive.

It depends purely on the terms of the guarantee contract. However, if you decide to opt out, you will have to approach the lender directly with an application. Unfortunately, the discretion is solely dependent on the lender whether or not it will let you go. You may also approach the bank with an application for a release if there is a substitute guarantor for the loan. If the bank is really convinced why you are opting out and is convinced about the credentials of the substitute borrower, it may set you free. For limitation period of personal guarantee click and read the following link

https://bankingschool.co.in/loans-and-advances/how-to-compute-period-of-limitation-for-personal-guarantees/