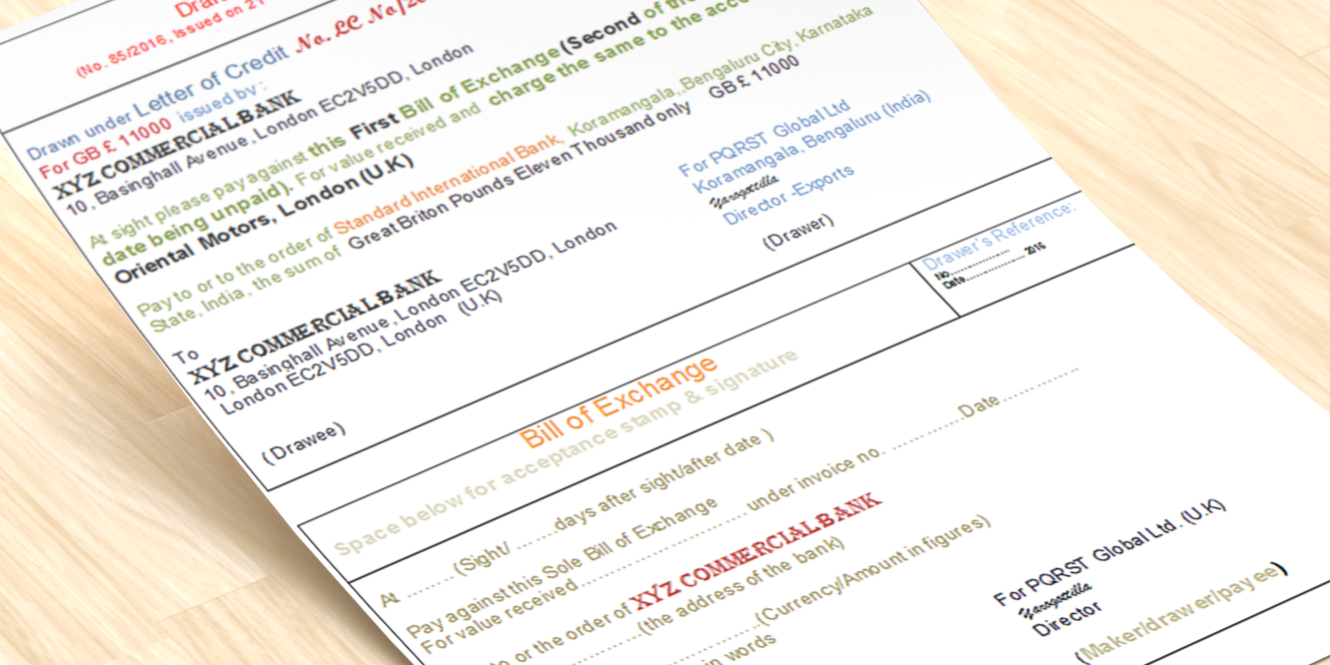

Co-acceptance of bills means “an undertaking from the third party (Bank) to make payment to the drawer of the bill (seller/exporter) on due date even if the buyer/importer fails to make the payment on that date”.

Thus, in the Co-acceptance of the bills, the bank which stands as co-accepter acts as a guarantor similar to LC opening and undertakes to make timely payment to the seller/exporter even if the buyer/importer fails to make payment on due date.

In terms of RBI regulations, the co-acceptance limits should be sanctioned only to the borrowers of the bank who enjoy other credit facilities with the bank and such limit should be sanctioned after ascertaining actual need of the client.

Benefits to the importer (buyer) under co-acceptance bills:

The Co-acceptance of bills facility is preferred by the importers of goods worldwide over opening Letter of Credits (LC) because of the monetary benefits compared to buying goods under LC. An importer of goods under LC has to pay LC commission to LC opening bank from the date of opening the LC which is much before the shipment of goods by the exporter (seller of the goods). Whereas the payment of commission for co-acceptance of bills by the banks applicable only after shipment made by the exporter and the documents to title reaches to the importer’s bank (Co-accepter Bank).Thus, the facility of co-acceptance of bills by the bank works out cheaper, compared to the opening of import LC.

Since the liability under co-acceptance of bills remains in the bank’s book for a shorter period compared to LC bills, there is an opportunity to the importer to rotate the facility more frequently as and when the preceding outstanding is eliminated.

Click below for related articles:

- Checklist for banks financing LC/ co-accepted bills

- Meaning of inland bills and foreign bills

- Meaning of DP bills, DA bills, and Acceptance of Bills,

- What are the Clean Bill, Documentary bill, Demand bill, Usance Bill, and Accommodation Bill

- Crystallization of overdue export bills

- Crystallization of Import LC bills

- Post shipment finance to exporters without packing credit facility

- How to liquidate packing credit loan without post-shipment finance?

- Meaning of Normal transit period and notional due date

sir, i am working in IOB , i was join in 2011. I have applied for CAIIB exam. Kindly update or send a notes to my mail. Thanking you,

S Senthil kumar

Dear Senthil Kumar,

Many people are requesting me to prepare MCQs and related notes for JAIIB/CAIIB. I’m on the job, but it may take a few months to complete the project. You may contact me next year if you need my assistance.Best of luck.

Surendra Naik