(Generally, there are eight parties involved in letter of credit transactions, out of which four principal parties involved in any transaction. This article briefs about four principal parties and other four ordinarily involved in letters of credit transactions).

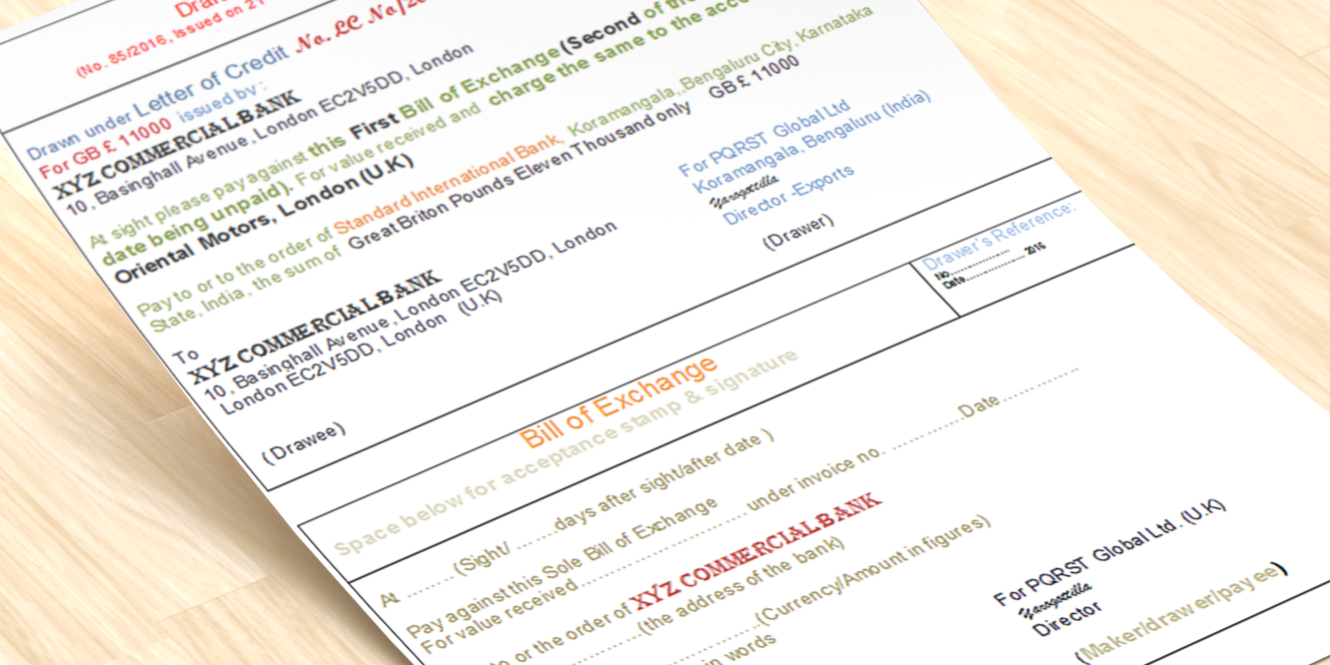

Definition of Letter of Credit: Letter of credit (LC) is an undertaking letter issued by the importer’s (buyer’s) bank wherein the seller is assured of full payment of goods/service sold by him on a condition that the supplier fulfills his part of the sale contract embodied in Letter of Credit.

Four principal parties involved in a Letter of credit transaction.

Applicant/opener:

The bank opens the Letter of Credit on behalf of the applicant (customer) who is normally a buyer of goods. The customer on whose behalf the LC opened is called ‘applicant’ or ‘opener’.

Issuing bank:

The bank which opens (issues) an LC and undertakes to make payment to the beneficiary on submission of documents as per terms of L.C is called LC issuing Bank.

Beneficiary:

The beneficiary of LC is one in whose favour LC is issued. The beneficiary is normally the seller who has to get payment from the buyer

The beneficiary of LC is one in whose favour LC is issued. The beneficiary is normally the seller who has to get payment from the buyer.

Advising bank:

The bank through whom LC is advised to the beneficiary is called Advising Bank. Advising bank will be situated normally in the place or country of the beneficiary.

Apart from above four principal parties to LC, the following four are ordinarily involved in letters of credit transactions they are;

Confirming Bank (Optional):

When LC issuing bank is unknown to the exporter (seller) another reputed bank of exporter’s country adds its confirmation to the LC. It means in addition to LC issuing bank, LC confirming bank undertakes the responsibility of payment under the credit.

Negotiating Bank:

Whichever bank negotiate the documents received under LC is called negotiating bank.

Paying Bank or nominated bank:

The issuing bank nominates/authorises another bank to make payment under the credit. The bank which makes the payment under credit is called paying the bank. It is important to note that it is not obligatory on the part of nominated bank to honour the documents presented to it unless the nominated bank and confirming bank is same. In practice, the nominated bank presents the documents received by it either to Issuing bank or Reimbursing bank for payment and transfers the credit proceeds received by it to the beneficiary’s account.

Reimbursing bank:

LC issuing bank will have the foreign currency accounts (NOSTRO Accounts) with the banks of other countries. LC issuing bank authorises the bank where it maintains accounts to honour the LC reimbursement claim of negotiating bank. The bank which makes reimbursement of the claim under LC is called the reimbursing bank.

Related article:

(i) Mechanism of letter of Credit transactions (ii) Connotations used in Letter of Credit transactions

(iii) All about different kinds of letters of credit (iv) Standby Letters of Credit of different types

(v) Uniform Customs and Practice for Documentary Credit